That was fast. It just entered the market a few months ago, but Compass can already boast of having the largest number of Austin's top home sellers.

from DIYS http://bit.ly/2Tp2Ijh

That was fast. It just entered the market a few months ago, but Compass can already boast of having the largest number of Austin's top home sellers.

malerapaso/iStock

Home sellers were raking in the dough last year, earning the highest profits on their abodes in a dozen years.

Those who sold their residences in 2018 made an average profit of $61,000—and West Coasters reaped even higher returns, according to a recent report from real estate information firm ATTOM Data Solutions. That’s up 22% from the median $50,000 they made in 2017, and it represents an average 32.6% profit.

To come up with its findings, ATTOM compared the original purchase price of homes with what they sold for in 2018. The data come from recorded sales deeds, foreclosure filings, and loan information.

The biggest profits were in Silicon Valley’s San Jose, CA, at 108.8%; San Francisco, at 78.6%; Seattle, at 70.7%; Merced, CA, at 66.4%; and Santa Rosa, CA, which was devastated by wildfires in 2017, at 66.1%. The analysis included only metros with populations of 200,000 and up with sufficient home price data available.

Prices rose so high in some of these metropolitan areas (which include cities and the surrounding suburbs), they’re now seeing a wave of price reductions as sellers are forced to lower their expectations. That’s one of the strong indicators that the good times are likely to slow down this year, along with the rest of the real estate market.

“There are potential clouds on the horizon,” Todd Teta, ATTOM’s chief product officer, said in a statement. “The effects of last year’s tax cuts are wearing off as limits on homeowner tax deductions are in place and mortgage rates are ticking up ever so slowly, so this could dampen the potential for home price gains in 2019.”

In the past few months, more sellers seeking big paydays rushed to put their homes up for sale while prices were still at record highs. At the same time, many buyers were sidelined by those same high prices, rising mortgage rates, and tax changes. Others are simply waiting to see how the market will sort itself out before taking the plunge. So with more supply and less demand nationally, selling homes may not be quite so lucrative going forward.

But there are some markets bucking the trend. The Mobile, AL, metropolitan area saw the largest price increases, at 21%; followed by Flint, MI, known for its recent water crisis, at 19%; San Jose, at 18.9%, Atlantic City, NJ, at 16.4%; and Las Vegas, at 13.5%.

The post You Won’t Believe How Much Home Sellers Pocketed in 2018 appeared first on Real Estate News & Insights | realtor.com®.

iStock; realtor.com

By now, the shock that Amazon is splitting its new headquarters into two—yes, two!—separate locations has subsided. Congrats, New York and DC! But as the fairy dust settles, it’s time for a reality check: Just a couple of months after the tech giant’s long-awaited announcement, there are some early signs of the real impact this will have on housing in the two urban markets that won the prize.

So far, it’s not quite playing out the way some pundits had predicted.

Without question, real estate agents in the HQ2 neighborhoods—Long Island City, across the river from Manhattan, and Crystal City, VA, a hop, skip, and a jump away from the Pentagon —are suddenly very busy. Investors are circling, and prices are swelling in anticipation of up to 25,000 jobs with average salaries of $150,000 moving into each location. But those hoping to see home and rent prices double overnight—or even this year—will certainly be disappointed.

Amazon’s meteoric rise has boosted real estate prices in its hometown of Seattle far beyond what anyone would have expected a decade ago. The billion-dollar question: Will the same thing happen in these East Coast cities?

“We’ll see a price impact,” particularly in the immediate vicinity of where the company sets up shop, says Chief Economist Danielle Hale of realtor.com®. “[But] New York and DC are already larger markets. … They will be able to adapt without the same run-up in prices that we saw in Seattle.”

Looking at Seattle’s past to predict the futureSo how will it play out?

Since Amazon’s announcement, prices have jumped 10% to 15% in both Long Island City and Crystal City, say local real estate agents. Sales in Long Island City, where hundreds of brand-new, luxury condos recently came onto the market, have spiked.

But in Crystal City (which Amazon is quixotically trying to rebrand as “National Landing”), a neighborhood of offices and hotels where inventory is extremely limited, sellers have been pulling their listings off the market. They’re hoping these properties will fetch more when the Amazon workers roll in.

Those hopes are fueled by Seattle’s example: Since Amazon began its rapid expansion there in 2010, home sale prices shot up nearly 91%, to hit a median of $725,000 in 2018, according to data from the Northwest Multiple Listing Service. In the Lake Union area, where the company is based, prices zoomed up almost 135%.

But that was over an eight-year span, starting when the housing market was near rock bottom. Prices had nowhere to go but up, especially as the economy improved and more buyers flooded the market.

“Housing prices are starting from a much higher point than we were in Seattle,” says Jeff Shulman, a marketing professor at the University of Washington, who has looked at Amazon’s impact on his city. “You can’t expect it’s going to play out the same way.”

Despite the economic recovery, homes have gotten so prohibitively expensive in many large cities that when mortgage rates went up recently, the housing market began slowing down. There are simply limits to what folks can afford, even techies making good money at companies such as Amazon.

| Market | Median List Price | Median List Price in HQ Neighborhood* | Average One-Bedroom Rent in HQ Neighborhood** |

| Seattle, WA | $664,950 | $499,250 | $2,180 |

| New York, NY | $1,087,753 | $992,500 | $3,056 |

| Washington, DC | $599,000 | $599,000 | $1,956 |

| *Neighborhoods: Seattle: South Lake Union New York: Long Island City Washington, DC: Crystal City |

** rental prices from apartments.com |

Let’s also face facts: A $150,000 salary simply isn’t the same in Seattle as it is in New York City and DC, which are already astronomically expensive markets. And we’re not just talking about the sticker price of homes.

There’s no state income tax in Washington state—a perk that can boost residents’ bank accounts. So while the overall tax burden (income, sales, property, and auto taxes) for those earning $150,000 was $20,153 in New York City and $12,975 in DC—it was just $8,579 in Seattle, according to the most recent Government of the District of Columbia report. There’s also a generally lower cost of living—enough of a difference to beef up a down payment, or get a larger mortgage.

“Your dollar just goes further in Seattle,” says Annie Radecki, a vice president at John Burns Real Estate Consulting.

The skinny on Long Island CityOnce upon a time, Long Island City was a seedy, industrial swath of Queens filled with warehouses and crime. But developers capitalized on its proximity to Manhattan, just one subway stop away. Over the past decade or so, they’ve erected a slew of gleaming, luxury towers along the East River, building the neighborhood from the ground up. And renters and buyers have dropped big bucks to live in them.

But the neighborhood is still cheaper than nearby Manhattan, which is key to its appeal—and may put a ceiling on just how high prices can go. Even with the higher demand for housing imposed by the torrent of new Amazon workers, prices will likely remain 10% to 15% below Manhattan prices, predicts real estate broker Eric Benaim, of the brokerage Modern Spaces. (The median Manhattan list price is $1,495,000, compared with Long Island City’s $992,500.)

“Do I see it gradually growing and increasing? Yes,” says Benaim, who’s been boosting Long Island City for a decade and has most of the listings there. “[But] I don’t see it jumping up 100%.”

But if Amazon’s presence makes Long Island City the place to be, who knows how high prices could soar?

Before the tech company’s announcement, there was a glut of luxury rentals—and to a lessor extent, condos—on the market here. Landlords and developers were slashing prices and offering concessions. But since the neighborhood was selected, interest in condos has skyrocketed with investors and buyers, and sales have spiked. About 350 to 400 condos have been sold since the November Amazon announcement—compared with the typical 15 to 20 sales during this time period, Benaim says. And prices are up 10% to 15%.

“We essentially went from a buyer’s market to a seller’s overnight,” Benaim says.

The rental market isn’t likely to spike quite as dramatically until the hordes of Amazon workers move in. But with an average monthly price of $3,056 for a one-bedroom apartment, it’s not clear how much higher even Amazon workers could afford for rents to go.

For now, there are plenty of homes to go around. There are several hundred condos still for sale and about 1,000 vacant rentals in the neighborhood. Over the next three years, an additional 2,600 condo units and 6,000 rental units are slated to come online. That amount of inventory is expected to keep prices from getting out of control.

Other nearby Queens neighborhoods, like more affordable Astoria and Woodside, and close Brooklyn communities such as Greenpoint and Williamsburg are also poised to benefit from the spillover of tech workers needing places to live. Some Amazon workers are likely to also live in Manhattan, particularly the Upper East Side, given how quick of a commute it is.

Crystal City: A new name in search of an identityThe future of Crystal City, a vast expanse of concrete-and-glass office parks in Arlington, VA, is likely to be a bit different. It’s starting off at a lower price point than Long Island City, at a median $543,000, and there is a dearth of available inventory.

Sellers are holding off putting their properties on the market in hopes of fetching higher prices when Amazon workers move in, say local real estate agents. Only eight homes in the neighborhood’s 22202 ZIP code were for sale as of Wednesday afternoon, according to realtor.com data.

Meanwhile, foreign and out-of-state investors have descended, bidding up prices as they compete against one another with all-cash offers. Local real estate agent Jordan Stuart recently sold a one-bed, one-bath condo as an investment property to an out-of-town NBA player who wants to get in on the Amazon action.

Before the announcement, the $420,000 condo had sat on the market with just four showings in the two months since it had been listed. But after the news, he had 60 showings on it and five offers on the property despite raising the sale price to $450,000.

“They’re setting new [price] thresholds,” says Stuart, of Keller Williams Capital Properties. As the neighborhood becomes more desirable, he anticipates prices will go up 20% to 25% over the next few years before hitting a plateau.

Many new residents will be forced to look outside of Crystal City for housing, at least initially. They’re apt to head into greater Arlington, where there are plenty of high-rise apartment buildings and single-family homes.

And many folks, particularly younger workers, will head to buzzy DC areas like the Wharf, the city’s new southwest waterfront district. The $2 billion development includes restaurant, retail, and office space; a 6,000-person concert hall; and hundreds of luxury apartments starting at around $2,000 a month.

But most of the Amazonians’ salaries aren’t likely to be high enough to purchase million- or multimillion-dollar homes.

“I don’t think [prices] will double. It’s not that type of market,” says Stuart. “But what will shake out is still a wild card.”

The post The Amazon Effect May Not Wind Up Being Prime for NYC and DC Housing appeared first on Real Estate News & Insights | realtor.com®.

Gabe Ginsberg/FilmMagic

Beyond the obvious, a polygamous relationship has its challenges. Selling four family homes is just one of those hurdles.

Janelle and Christine Brown—stars of the TLC reality show “Sister Wives”—have both had to slash the asking prices on their Las Vegas homes. Now the other two sister-wives, Meri and Robyn, have put their similar Vegas homes on the market, although they haven’t had to change the asking prices—yet.

All four of the Las Vegas homes are located in the same gated community. The four women, who are all in a relationship with Kody Brown, have since relocated to Flagstaff, AZ.

Janelle and Christine both put their homes on the market in 2018, while Robyn and Meri only recently did so in the new year.

For those unfamiliar with the popular TLC show, it follows Kody, an ad salesman, and his “wives” Meri, Janelle, Christine, and Robyn, as well as their 18 children.

Brown is legally married only to Robyn. The other women consider themselves married through spiritual union. The show is the family’s attempt to bring awareness to their polygamous lifestyle and has run for 12 seasons on TLC.

The four women have lived in four homes in the gated estate since 2012, so most fans will recognize these abodes. After Season 12, the family moved out of the four Vegas dwellings now on sale.

Christine was first to put her five-bedroom home on the market last July, for $675,000. It boasts a dramatic foyer entry into a formal living room, updated cabinetry, and a “great” backyard. She reduced the price to $649,000 in the fall. It was further trimmed to $639,000 and now stands at $614,900.

Christine’s five-bedroom home, listed for $614,900

Christine’s five-bedroom home, listed for $614,900

realtor.com

Janelle listed her six-bedroom place for $649,000 last year, before reducing it to $599,900 in the new year. The “spectacular” floor plan includes a huge kitchen with granite counters and a master suite with spa bath. There are also covered patios.

Janelle’s six-bedroom home, listed for $599,900

Janelle’s six-bedroom home, listed for $599,900

realtor.com

Meri, who recently opened a bed-and-breakfast in Parowan, UT, just listed her 4,200-square-foot home for $599,000. Standout features include a large loft with a balcony and mountain views, plus upgraded appliances, cabinetry, carpet, and tile.

Meri’s 4,200-square-foot home, listed for $599,000

Meri’s 4,200-square-foot home, listed for $599,000

realtor.com

Robyn just listed her residence as well, for $619,900. Her five-bedroom home includes a den with mountain views, large and open rooms, and an outside play area, featuring an in-ground trampoline, planter boxes, a fire pit, and covered patios.

Robyn’s five-bedroom home, listed for $619,900

Robyn’s five-bedroom home, listed for $619,900

realtor.com

According to InTouch Weekly, Kody owns a parcel of land in Flagstaff, which was divided into four lots. It looks like the Brown family found a new compound, which probably means they are motivated to sell their now empty Vegas nests.

All four listings are represented by agent Thomas J. Love.

The post ‘Sister Wives’ Stars Selling Off Their 4 Las Vegas Homes appeared first on Real Estate News & Insights | realtor.com®.

realtor.com

Ideal for the festival set, this tiny cabin nestled into the desert landscape of Joshua Tree, CA, is now on the market for $199,000. The funky vacation getaway includes three structures on the property: the cabin, a trailer known as a “canned ham,” and two shipping containers that serve as hangout space on the private 5 acres.

The property is located about 10 miles away from Joshua Tree National Park, and is about 2.5 hours from Los Angeles, making it accessible as a weekend retreat that only feels worlds away.

“It’s so different than anywhere else in Southern California,” listing agent John Simpson says. “It’s just quiet and serene and beautiful. You feel like you went to a whole other world, but it’s just a couple of hours on the freeway. You can see as far as the eye can see. You can get amazing sunsets and sunrises.”

Plus, he points out, there’s never a problem with parking. Or traffic, for that matter. (A welcome change for city dwellers.)

The cute cabin itself, built in 1957, was a result of a 1930s-era government program, designed as a way for the government to unload unwanted land in 5-acre parcels.

Joshua Tree cabin

Joshua Tree cabin

realtor.com

Sitting area with wood-burning stove

Sitting area with wood-burning stove

realtor.com

Kitchen and eating nook

Kitchen and eating nook

realtor.com

Covered outdoor dining area

Covered outdoor dining area

realtor.com

Bedroom in trailer

Bedroom in trailer

realtor.com

Outdoor shower

Outdoor shower

realtor.com

Shipping container with quirky decor

Shipping container with quirky decor

realtor.com

There was a catch to snagging a parcel for a rock-bottom price. Buyers had to agree to put up a minimum structure, or “homestead,” on their land.

“This was one of those,” Simpson says of the cinder block cabin. Many of the cabins in the area went up as part of the government act. But, he adds, the cabins were usually never inhabited and simply built in order to meet the minimum requirements of the land sell-off.

When the previous owner bought the property, the cabin had actually never been used. And it’s no wonder. It had no kitchen, no bathroom, and no bedroom. So a small kitchen and sitting area with a wood-burning stove were added to the 192-square-foot space. A cozy adjacent trailer includes the bedroom and bathroom, as well as an outdoor shower.

A covered dining area allows for outdoor meals, and the indoor space also has room for a small eating nook.

A shed contains laundry and storage, and two shipping containers help define the outside space. Spruced up by the previous owner, an artist, the containers feature a pingpong table and some light-hearted additions, including a mannequin’s legs that look to be sticking out from under the building, and doodles and drawings decorating the container walls.

The owner bought the cabin as a writer’s retreat, and Simpson notes that the area attracts an artsy crowd, who find inspiration in the awe-inspiring surroundings.

With 5 acres, there’s plenty of room to spread out and roam. Joshua Tree has become a popular spot for vacation rentals, and when not in use by the owner, this property has been steadily rented out on Airbnb.

Just about 10 miles from the park entrance, it’s an easy drive to the few restaurants and cafes that have opened up. Larger chain stores can be found about an hour away in Palm Springs. Plus, it’s a little over an hour away from the Empire Polo Club in Indio, where the annual Coachella festival takes place.

Or, you don’t have to leave at all. Simply walk outside and bask in the eerily beautiful desert landscape.

The post Hey, Coachella Fans! Quirky Cabin in Joshua Tree on the Market for $199K appeared first on Real Estate News & Insights | realtor.com®.

iStock

The numbers: Pending-home sales slid 2.2% in December to a reading of 99, and were 9.8% lower compared to a year ago, marking the 12th straight month of annual declines, the National Association of Realtors said Wednesday.

That’s the lowest reading since April 2014.

What happened: NAR’s index, which tracks home contract signings, missed the Econoday consensus for a 0.3% monthly increase. Given all the headwinds facing the housing market at the end of last year, that forecast may have been too rosy.

In December, the pending home sales index for the Northeast was up 2%. The index for the West were also up moderately, by 1.7%. But pending sales plummeted in the South by 5%, and in the Midwest by 0.6%.

Big picture: The Realtor group named a litany of culprits for the steep decline in December: the stock market correction, high home prices and mortgage rates, lean inventory, and even the government shutdown.

Contract signing usually precede closing by about 45 days, so the pending home sales index is a leading indicator for upcoming existing-home sales reports.

Market reaction: The Dow Jones Industrial Average was little changed after the NAR release. The Dow has climbed over 5% this month.

The post Pending Home Sales Tumble to Lowest in Nearly Five Years in December appeared first on Real Estate News & Insights | realtor.com®.

Amanda Edwards/WireImage; realtor.com

Pop music impresario Simon Fuller, the man behind “American Idol” and the global “Idol” franchise, is voting to sell his mansion in L.A.’s Bel Air neighborhood. After initially listing the home in October for $37.5 million, Fuller recently dropped the price to $35 million.

He and his wife, interior designer Natalie Swanston, purchased the 11,200-square-foot home in 2014 for $24 million.

The listing came after the couple made serious upgrades to the seven-bedroom mansion. The home was built in 1927 by architect Gordon Kaufmann (who also built Beverly Hills’ famous Greystone Manor) and updates were done with a careful eye toward preserving the home’s architectural heritage.

Described as an “iconic gem,” the home still maintains its original Georgian bones. However, instead of the red brick exterior it featured when Fuller bought it from billionaire David Murdock, the bricks are now painted a stately white. There are a few black accents dropped in around the home’s awnings, window panes, and front door.

Simon Fuller’s Bel Air estate

Simon Fuller’s Bel Air estate

realtor.com

The red bricks were painted white.

The red bricks were painted white.

realtor.com

The home’s interior is almost completely done up in au courant shades of black, white, and gray—with occasional pops of color in the furniture and accessories.

Living room

Living room

realtor.com

Family room

Family room

realtor.com

Kitchen

Kitchen

realtor.com

One of the features truly setting this home apart is the turret. It houses a wood-paneled library with a fireplace on the ground floor, and a circular office, also with a fireplace, above it.

Wood-paneled library

Wood-paneled library

realtor.com

Office with fireplace

Office with fireplace

realtor.com

Turret with round office and library

Turret with round office and library

realtor.com

According to the listing, the white-on-white master suite is a “world unto itself” with a large entrance vestibule, office, gym, dual baths, and gargantuan closet.

The grounds, which measure 1.6 acres, include a gated motor court, guesthouse, greenhouse, green lawns, and a pool and spa.

Fuller and Murdock are not the only prominent owners of this mansion, which was known for decades as the Fredricks residence. In the 1990s, fashion designer Mossimo Giannulli and his wife, actress Lori Loughlin (“Full House”), enjoyed the views of Los Angeles to the ocean from the house on a hill.

Fuller, 58, is one of the most successful pop music producers ever. In addition to his stint managing the Spice Girls, he’s managed Carrie Underwood, Kelly Clarkson, and numerous other pop acts. In addition to the 150 versions of the “Idol” franchise airing around the world, he’s also the co-creator of “So You Think You Can Dance.”

He’s diversified and global when it comes to real estate, reportedly owning homes in England, France, and Uruguay.

The post ‘Idol’ Creator Simon Fuller Selling His $35M ‘Iconic Gem’ in Bel Air appeared first on Real Estate News & Insights | realtor.com®.

The luxury real estate market in Houston demands consummate counsel, exceptional connections, a laser-like focus, and above all, maximum discretion — s.

The luxury real estate market in Houston demands consummate counsel, exceptional connections, a laser-like focus, and above all, maximum discretion — s.

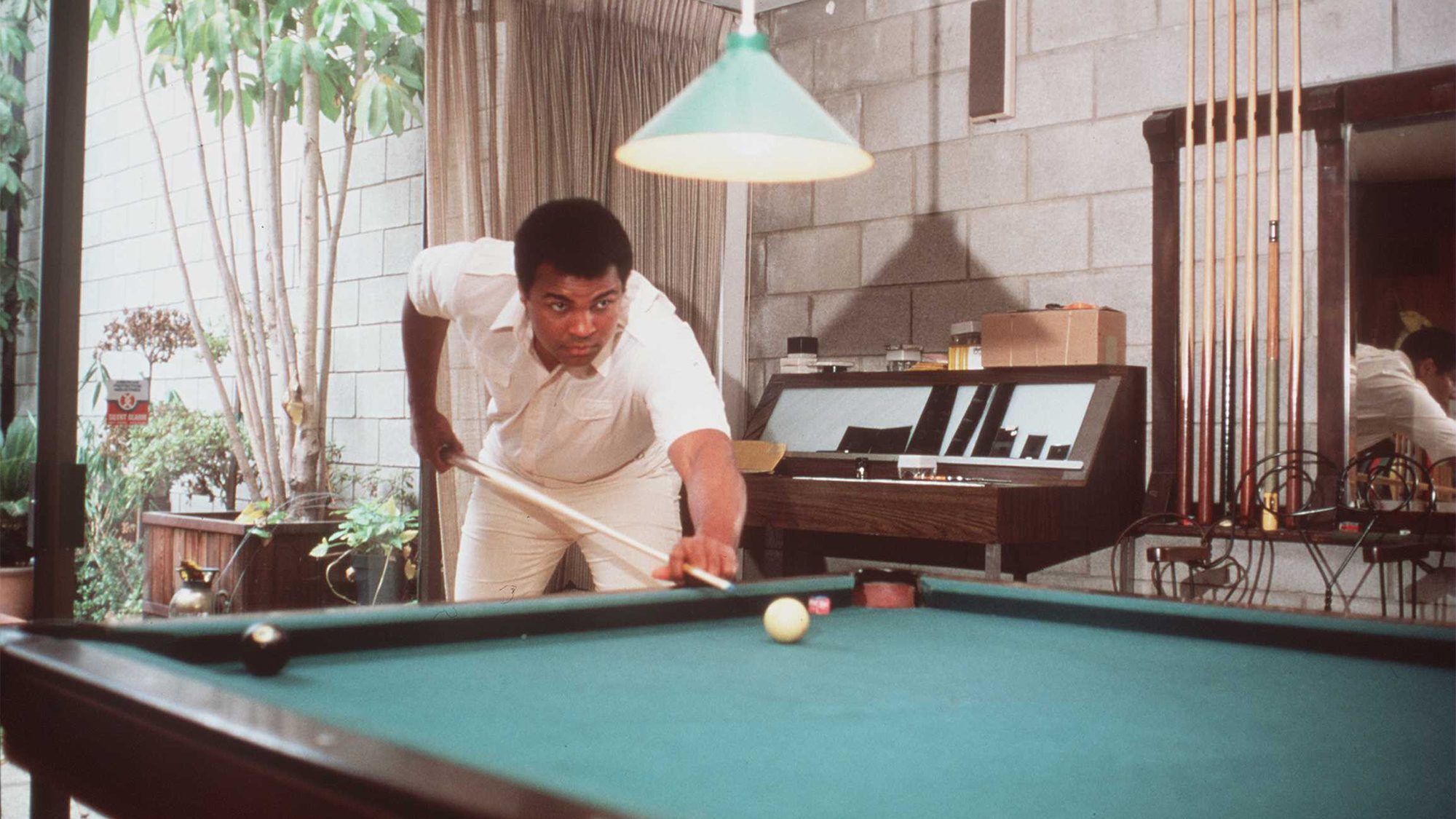

Paul Harris/Online USA, Inc.

A magnificent mansion in Los Angeles once owned by boxer Muhammad Ali is taking a swing at the market for $16.9 million, according to the Wall Street Journal.

Ali, who died in 2016 at the age of 74, lived there during his marriage to his third wife, psychologist Veronica Porché Ali. The couple bought the estate in 1979 and lived there until their divorce in 1986.

Built in 1916, the home last changed hands in 2001 for $2.5 million. If the sellers get close to the asking price—even considering any cash they’ve invested—they will walk away with a heavyweight profit.

You’ll definitely feel like a champion in this glorious Hancock Park home.

Muhammad Ali’s former home

Muhammad Ali’s former home

realtor.com

Staircase and stained-glass window

Staircase and stained-glass window

realtor.com

Living room with built-in bookshelves

Living room with built-in bookshelves

realtor.com

Sunroom

Sunroom

realtor.com

Parklike grounds

Parklike grounds

realtor.com

Backyard with pool

Backyard with pool

realtor.com

Set behind the private gates of Fremont Place, the 11,545-square-foot home sits on 1.6 acres of parklike grounds, and includes nine bedrooms and seven bathrooms. The large guesthouse contains an additional bedroom and full bath.

Designed by architect John C. Austin, known for his work on the iconic Griffith Observatory, many original details remain, including Tiffany stained-glass windows, chandeliers, and stone fireplaces. The home has also undergone renovations over the years, according to the Real Deal.

Other standout features include a skylit sunroom, floor-to-ceiling bookshelves, and outdoor space that includes a pool.

According to the Journal, during Ali’s time, many bold-faced names visited the Greatest at this residence, including Sylvester Stallone, Clint Eastwood, and Michael Jackson.

Ali, a professional athlete, activist, and superstar, is considered one of the greatest boxers of all time. In 1967, he refused to be drafted into the Vietnam War, citing his religious beliefs, a controversial decision in that era. Along with his conscientious objector stance, he became a voice in the civil rights movement.

Stefani Stolper of Douglas Elliman holds the listing.

The post Former L.A. Mansion of Muhammad Ali on the Market for $17M appeared first on Real Estate News & Insights | realtor.com®.

realtor.com

Known as the Beach house, this classic Victorian on the market for $3.3 million in Escondido, CA, is nowhere near the beach.

Although this vintage gem is located in San Diego County, you will not hear the sound of waves crashing nearby. This Beach house sits pretty atop a knoll almost 15 miles inland from the Pacific Ocean.

Built by Albert H. Beach (hence the home’s name!) in 1896, the classic home has plenty of charm, but proximity to sand is not one of them. The property’s half-acre grounds are green and expansive and include immaculately manicured hedges and gardens, stately palm trees, intimate conversation and dining areas, terraces, and sparkling water features.

There’s also a period-appropriate, Swiss-Victorian gazebo, assembled in the tongue-and-groove method, with nary a nail. And the lamp that hangs in the gazebo is notable—it once hung in the home of Wyatt Earp. The quaint structure is just crying out for a bride and groom to softly murmur “I do”—which should give you a hint of the ideal use for this property.

Classic Victorian in Escondido, CA

Classic Victorian in Escondido, CA

realtor.com

Terrace with view of the grounds

Terrace with view of the grounds

realtor.com

Swiss-Victorian gazebo

Swiss-Victorian gazebo

realtor.com

Although it’s currently a private residence, listing agent Amy Ali of Compass believes the Beach house would be perfect as a bed-and-breakfast or a venue for events such as weddings, teas, or philanthropic activities. Located close to a Catholic university, it could easily serve as a chancellor’s residence, Ali adds.

Ali also notes the virtues of its lavish indoor features. Foremost among them is elaborate wallpaper extending to the ceiling. The hand-printed Bradbury & Bradbury wallpaper—custom-designed for this home—took over six months to apply and cost hundreds of thousands of dollars.

A previous owner spent millions of dollars and decades of his time restoring the estate to its original glory.

Original staircase

Original staircase

realtor.com

Many of the home’s original features were renovated and restored, including the gas lamps that were converted to electricity.

Craftsmen spent months working on the home.

Craftsmen spent months working on the home.

realtor.com

The 3,300-square-foot home has four bedrooms and 2.5 baths. Every inch of this home has the mark of a craftsman—there are custom-made, hand-crafted wood doors, antique fixtures, and stained- and leaded-glass windows done to period perfection.

Sunroom

Sunroom

realtor.com

Original door and hardware

Original door and hardware

realtor.com

There are also expertly restored pieces of furniture that have been in the home since it was built, including sofas upholstered in red silk and custom-built bedroom sets. The price of the furniture is negotiable along with the purchase price for the home.

Parlor with original furniture

Parlor with original furniture

realtor.com

Bedroom

Bedroom

realtor.com

The home’s infrastructure, kitchen, and bathrooms have been seamlessly updated so they blend right in. The detached garage, now used for covered parking, a gym, and a “Martha Stewart–worthy laundry room,” according to Ali, is topped by solar panels that power the house.

Note the solar panels on the garage.

Note the solar panels on the garage.

realtor.com

Kitchen

Kitchen

realtor.com

Bathroom with antiques

Bathroom with antiques

realtor.com

The estate is on the National Register of Historic Places and is part of the Mills Act. It’s also been featured in San Diego Home and the San Diego Union-Tribune.

Historic estate

Historic estate

realtor.com

The home’s located within walking distance of downtown Escondido’s Grand Avenue, so residents can stroll to numerous fine restaurants, the Mingei Museum, and the nearby California Center for the Performing Arts.

The home itself is “like a museum inside,” says Ali. “The photos don’t do it justice. No expense was spared in the restoration.” She asserts that anyone who appreciates Victorian style would be right at home in this historic treasure.

The Victorian home sits atop a lush knoll.

The Victorian home sits atop a lush knoll.

realtor.com

The post Fabulous Victorian ‘Beach House’ Is Nowhere Near the Beach?! appeared first on Real Estate News & Insights | realtor.com®.

Daniel Acker/Bloomberg via Getty Images

Home-price growth continued to ease off the accelerator in November, bolstering economists’ predictions that price growth could slow to be more in line with increases in incomes and inflation this year.

The S&P CoreLogic Case-Shiller National Home Price Index, which measures average home prices in major metropolitan areas across the nation, rose 5.2% in the year ending in November, down from a 5.3% increase reported in October.

Price growth slowed considerably in the final months of last year compared to the beginning of the year when prices were growing more than 6%. Many economists expect it to slow even further this year, with price growing in line with inflation at around 2% or 3%. That could be welcome news for buyer who have been struggling with affordability as mortgage rates rose late last year.

“The pace of price increases are being dampened by declining sales of existing homes and weaker affordability,” said David Blitzer, managing director at S&P Dow Jones Indices.

The Case-Shiller 10-city index gained 4.3% over the year, down from 4.7% the prior month. The 20-city index dipped below 5%, gaining 4.7% compared to a year earlier.

Economists surveyed by The Wall Street Journal expected the 20-city index to grow 4.8%.

Las Vegas had the fastest home price growth in the country for the sixth straight month at 12%, followed by Phoenix, where prices grew 8.1%. Seattle returned to the top three after falling out last month, but still prices there grew just 6.3%— about half where growth was a year ago.

About a third of the 20 cities reported greater annual increases in October than November.

Home-price growth combined with rising mortgage rates has slowed sales in recent months. Existing home sales posted their largest annual decline in seven years in November and fell to their lowest level in more than three years in December.

The post Home-Price Growth Continues to Slow appeared first on Real Estate News & Insights | realtor.com®.

Matt Winkelmeyer/Getty Images

Miami Heat President Pat Riley has brought some heat to the real estate market. He and wife Christine purchased a unit in the Four Seasons Residences at the Surf Club in Surfside, FL, for $8.1 million, the Real Deal reported.

While no photos are available of the Rileys’ unit, the fifth-floor condo they purchased has four bedrooms, five bathrooms, and 3,948 square feet, according to the listing.

The Surf Club development, completed in 2017, was designed by architect Richard Meier and local architecture firm Kobi Karp. There are currently seven units in the development on the market, at prices ranging from $3.5 million to $18.5 million.

The Surf Club Four Seasons

The Surf Club Four Seasons

realtor.com

Marketing materials for the private residences showcase floor-to-ceiling glass walls, up to 20-foot-high ceilings, and custom indoor-outdoor transitions to terraces that range up to 18 feet in depth. Frameless glass balcony railings on the terrace offer unobstructed views of the Atlantic.

Finishes include travertine or wood flooring, Meier-designed master baths, and Boffi and Meier custom-designed kitchens with Corian counters, and Miele and Sub-Zero integrated appliances.

Some of the high-end units feature their own swimming pools, courtyards, and outdoor showers and kitchens.

The oceanfront project includes a 72-room hotel as well as two 12-story towers with 150 units, with upscale perks such as two pools, a gym, a health and wellness center, and a Thomas Keller restaurant.

The basketball executive joins an exclusive list of residents at the Miami Beach towers attached to the luxury hotel, including former Esquire publisher Alan Greenberg, real estate developer Richard Ruben, and Groupon founder Eric Lefkofsky.

The site includes the restored original Surfside beach club that dates to 1930 and boasted such high-profile guests as the Duke and Duchess of Windsor.

Now, with Riley’s purchase, the condo can also boast the addition of the “Godfather.” Riley is the president of the Miami Heat, and is considered one of the greatest NBA coaches of all time. The 73-year-old served as head coach for five championship teams.

The post Pat Riley Reportedly Buys Florida Condo at Surf Club Four Seasons for $8.1M appeared first on Real Estate News & Insights | realtor.com®.